|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

MANAGEMENT'S DISCUSSION AND

ANALYSIS

(Amended)

FOR THE THREE AND SIX MONTHS

ENDED

FEBRUARY 28, 2019 AND 2018

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

EXPLANATORY NOTE

Petroteq Energy Inc. ("Petroteq" or the "Company") is filing this Amendment to its unaudited condensed consolidated interim financial statements for the three and six months ended February 28, 2019 and 2018 (this "Amendment") to amend the Company's condensed consolidated interim financial statements for the three and six months ended February 28, 2019 (the "Original Filing"), originally filed by the Company with the Canadian Securities Administrators ("CSA") on the SEDAR filing system on April 29, 2019. This Amendment amends the Company's previously issued unaudited condensed consolidated interim financial statements and related note disclosures as of and for the three and six months ended February 28, 2019 and 2018.

Background of Amendment

On July 16, 2021, the independent members of the Audit Committee (with Mr. Alex Blyumkin abstaining, the "Audit Committee") of the Board of Directors of the Company, after discussion with the Company's Chief Financial Officer, concluded that the Company's previously-issued financial statements (the "Periodic Financial Statements") contained in the interim financial report and interim MD&A (together, the "amended interim filings") of Petroteq Energy Inc. (the "issuer") for the interim period ended February 28, 2019 should be amended and refiled.

The Board of Directors has concurred with the conclusions of the Audit Committee.

The amendment addresses a secured promissory note which the Company had issued ted December 27, 2018 (the "Note") payable to Redline Capital Management S.A. ("Redline") in the principal amount of $6,000,000, maturing 24 months following its date of issue, and bearing interest at the rate of 10% per annum based on a 360-day year. The Company's obligations under the Note are purportedly secured by collateral consisting of the Company's right, title and interest in certain federal oil and gas leases (the "Oil and Gas Leases") relating to the Company's Asphalt Ridge Project, pursuant to a security agreement between the parties dated December 27, 2018 (the "Security Agreement").

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

The Note had been issued pursuant to the terms of a settlement agreement between the parties dated December 27, 2018 (the "Settlement Agreement") which purported to settle certain claims asserted by Redline against the Company. Shortly following the Settlement Agreement, in early 2019, Mr. Blyumkin, who was then the Company's Executive Chairman, had indicated he undertook an internal review of the claims made by Redline and concluded that the Settlement Agreement, the Note and the Security Agreement are void and unenforceable, and that they did not have to be disclosed to the Board of Directors or to the Company's Chief Financial Officer. Mr. Blyumkin has indicated he verbally advised Redline that the Company now considered the Settlement Agreement, and therefore the Note and the Security Agreement, to be void and unenforceable. However, no action was taken to document this position. Since maturity of the Note, on December 27, 2020, Redline has not filed any legal action to enforce payment of the Note.

In response to a request from Staff at the Securities and Exchange Commission ("SEC"), Mr. Blyumkin determined that it was appropriate to raise the Settlement Agreement, the Note and the Security Agreement for consideration by the Company's Chief Financial Officer and the Audit Committee, and, in particular, to review his conclusion that they did not have to be disclosed in the Financial Statements. The Audit Committee has determined that, notwithstanding the results of the internal review of Redline's claims undertaken by Mr. Blyumkin in early 2019, the Settlement Agreement, the Note and the Security Agreement should have been disclosed, and that the obligations referenced in the Note should have been disclosed in the Financial Statements regardless of the Company's position of their validity and enforceability.

Special legal counsel was subsequently engaged by the Company to undertake a review of the Settlement Agreement, the Note and the Security Agreement with the view to determining whether they are enforceable (and, in particular, whether the Security Agreement has properly charged the Company's right, title and interest in the Oil and Gas Leases as personal property, and whether any security interests purportedly granted pursuant to the Security Agreement have been perfected under applicable law), and whether the related liability should be classified as an actual or contingent liability. Based on the advice of such legal counsel, the Company has determined that the liability purportedly represented by the Note should be classified as a contingent liability.

Items Amended

The Notes to the Condensed Consolidated Interim Financial Statements are amended Each of the following items are amended to include additional Legal Matters disclosure in Note 23 - Commitments which heading has been amended from Commitments to Commitments and Contingencies; the Management Discussion and Analysis related to the Unaudited Condensed Consolidated Interim Financial Statements for the three and Six months ended February 28, 2019 and 2018, has been restated by amending Item 15 - Litigation and Contingencies to include Legal Matters disclosure and Item 16 - Risks and Uncertainties to include additional risks as a result of the additional contingent liability disclosure; and the certifications of the Chief Executive Officer and Chief Financial Officer has been reissued. .

Except for the foregoing amended and/or restated information required to reflect the effects of the restatement of the financial statements as described above, and applicable cross-references within this Amendment, this Amendment does not amend, update, or change any other items or disclosures contained in the Original Filing. This Amendment continues to describe conditions as of the date of the Original Filing, and the disclosures herein have not been updated to reflect events, results or developments that have occurred after the date of the Original Filing, or to modify or update those disclosures affected by subsequent events. Accordingly, forward looking statements included in this Amendment represent management's views as of the date of the Original Filing and should not be assumed to be accurate as of any date thereafter. This Amendment should be read in conjunction with the Original Filing and our filings made with the CSA on the SEDAR filing system subsequent to the Original Filing date.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

1) Introduction

The following management's discussion and analysis ("MD&A") of the financial position and results of operations of Petroteq Energy Inc ("PQE", or the "Company") for the three and six months ended February 28, 2019 and 2018 was prepared in accordance with the requirements of National Instrument 51-102 - Continuous Disclosure Obligations by management of the Company on April 29, 2019 and should be read in conjunction with the condensed consolidated interim financial statements and notes thereto for the three and six months ended February 28, 2019 and 2018;

References to "PQE" and the "Company" herein refer to the Company and its subsidiaries taken as a whole.

The condensed consolidated interim financial statements for the three and six months ended February 28, 2019 and 2018 and any comparative information presented therein, have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB") and interpretations of the IFRS Interpretations Committee ("IFRIC") as of April 29, 2019.

All dollar figures in this management discussion and analysis are presented in United States dollars unless otherwise indicated.

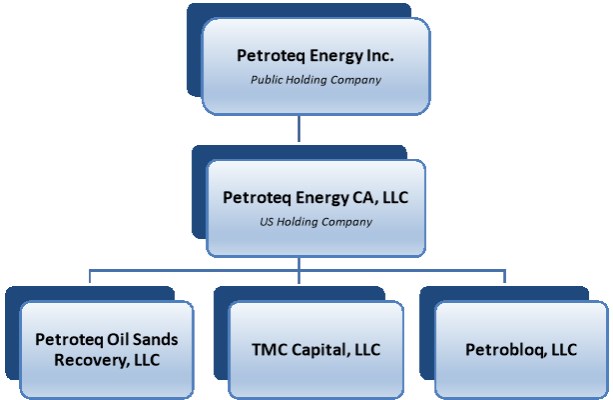

As of the date hereof the Company has one wholly-owned subsidiary, Petroteq Energy CA, Inc. ("PQECA"), a California corporation, which has three wholly-owned active subsidiary companies, Petroteq Oil Sands Recovery, LLC ("POSR"), TMC Capital, LLC ("TMC") and Petrobloq LLC ("Petrobloq").

On July 4, 2016, the Company acquired a 57.3% interest in a Houston-based, exploration and production (E&P) company, Accord GR Energy, Inc. ("Accord") in consideration for the issuance of 59,698,300 common shares (1,989,943 post consolidated shares) of the Company and the issuance of common share purchase warrants to purchase 2,000,000 common shares (66,667 post consolidated shares) of the Company at $0.25 per share ($7.50 per post consolidated share) for a period of three years. Due to additional cash injections and share subscriptions in Accord by unrelated shareholders during prior periods, the Company's ownership of Accord decreased to 44.7% and has therefore deconsolidated the results of Accord from the financial statements and accounts for the investment in Accord using the equity basis of accounting.

On April 6, 2017, the Company held a shareholders' meeting and obtained approval to change the name of the Company to "Petroteq Energy Inc" and to consolidate its share on a 30 for 1 basis, reducing the number of its outstanding shares. The consolidation was completed on May 5, 2017. All share figures and share-based calculations herein have been adjusted to reflect the consolidation.

In November 2017, the Company formed a wholly owned subsidiary, Petrobloq, LLC, to design and develop a blockchain-powered supply chain management platform for the oil and gas industry.

On June 1, 2018 the Company finalized the acquisition at auction of a 100% interest in two leases for 1,312 acres of land within the Asphalt Ridge, Utah area. The Company holds a 100 percent working interest in 2,541.73 acre Oil Sands Leases covering oil sands within the Asphalt Ridge area, Utah, USA. The lease grants an interest to all crude bitumen containing contingent resources of 87.495 MMbbl (C2 best estimate) on the 2,541 acres of leased lands and the Company has identified that the significant portion of the contingent resource has favorable characteristics for surface mining. The leased land contains oil sands deposits which the Company believes will increase the available resource utilized by its oil extraction plant.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

On April 3, 2019, the Company closed the acquisition of a 50% operating rights and interests related to oil sands under U.S. Federal oil and gas leases encompassing approximately 8,480 gross acres (4,240 net acres, less royalty) in the State of Utah. The total consideration for the acquisition was $10,800,000 settled as to cash, paid in January 2019 of $1,800,000 and $9,000,000 settled by the issue of 15,000,000 shares of the Company common stock at a deemed value of $0.60 per share.

The Company is now primarily focused on developing its oil sands extraction business and related mining interests.

The Audit Committee of the directors of the Company has reviewed the MD&A and other publicly reported financial information for usefulness, reliability and accuracy.

Additional information related to the Company may be found on the Company's website at www.petroteq.energy and on SEDAR at www.sedar.com .

This MD&A contains forward-looking information and statements. The effective date of this MD&A is April 29, 2019.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

Cautionary Note Regarding Forward-Looking Information

This MD&A contains certain forward-looking information and forward-looking statements, as defined in applicable securities laws (collectively referred to herein as "forward-looking statements"). These statements relate to future events or the Company's future performance. All statements other than statements of historical fact are forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "continues", "forecasts", "projects", "predicts", "intends", "anticipates" or "believes", or variations of, or the negatives of, such words and phrases, or state that certain actions, events or results "may", "could", "would", "should", "might" or "will" be taken, occur or be achieved.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those anticipated in such forward-looking statements. The forward- looking statements in this MD&A speak only as of the date of this MD&A or as of the date specified in such statement. Specifically, this MD&A includes, but is not limited to, forward-looking statements regarding: the validation of and commercial viability of PQE's Extraction Technology (defined below); the ability of the Extraction Technology to commence commercial production; the environmental friendliness of the Extraction Technology; the bbl/d capacity of the Extraction Technology; the schedule for certain events to occur and production to commence; capital efficacy and economics of the Extraction Technology; completion of certain acquisitions; potential of PQE's properties to contain reserves; PQE's ability to meet its working capital needs; the plans, costs, timing and capital for future exploration and development of PQE's property interests, including the costs and potential impact of complying with existing and proposed laws and regulations; management's outlook regarding future trends; sensitivity analysis on financial instruments, which may vary from amounts disclosed; prices and price volatility for oil and gas; and general business and economic conditions.

Inherent in forward-looking statements are risks, uncertainties and other factors beyond the Company's ability to predict or control. These risks, uncertainties and other factors include, but are not limited to, oil and gas reserves, price volatility, changes in debt and equity markets, timing and availability of external financing on acceptable terms, the uncertainties involved in interpreting geological data and confirming title to properties, the possibility that future exploration results or the validation of technology will not be consistent with the Company's expectations, increases in costs, environmental compliance and changes in environmental and other local legislation and regulation, interest rate and exchange rate fluctuations, changes in economic and political conditions and other risks involved in the oil and gas industry, as well as those risk factors listed in the "Risk Factors" section below. Readers are cautioned that the foregoing list of factors is not exhaustive of the factors that may affect the forward-looking statements. Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward-looking statements contained in this MD&A. Such statements are based on a number of assumptions that may prove to be incorrect, including, but not limited to, assumptions about the following: the availability of financing for PQE's exploration and development activities; operating and exploration costs; PQE's ability to retain and attract skilled staff; timing of the receipt of regulatory and governmental approvals for exploration and production projects and other operations; market competition; and general business and economic conditions.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance or achievements to be materially different from any of its future results, performance or achievements expressed or implied by forward-looking statements. All forward-looking statements herein are qualified by this cautionary statement. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information or future events or otherwise, except as may be required by law. If the Company does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements, unless required by law.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

2) Company Overview

The common shares of PQE are listed on the TSX Venture Exchange (the "TSXV") under the trading symbol "PQE" and on the OTCQX under the trading symbol "PQEFF".

As of the date hereof the Company has one wholly-owned subsidiary, Petroteq Energy CA, Inc. ("PQECA"), a California corporation, which has three wholly-owned active subsidiaries, Petroteq Oil Sands Recovery, LLC ("POSR"), TMC Capital, LLC ("TMC") and Petrobloq, LLC "(PBQ"), as shown in the organization chart below. In addition, the Company holds two equity accounted investments; Recruiter.com (25%) held directly and Accord GR Energy, Inc. (44%) held indirectly through PQECA.

PQE, through its wholly owned subsidiaries POSR and TMC, is in the business of oil sands mining and processing with a plant using proprietary extraction technology to recover oil from surface mined bitumen deposits. TMC holds mining leases containing contingent resources of 87.495 MMbbl (C2 best estimate) on the 2,541 acres of leased lands at Asphalt Ridge in Uintah County, Utah. PQE recently closed an acquisition of a 50% operating rights and interests related to oil sands under U.S. Federal oil and gas leases encompassing approximately 8,480 gross acres (4,240 net acres, less royalty) in the State of Utah. POSR owns an oil sands extraction facility (the "Plant") which was relocated during the prior fiscal year to the TMC mining site to improve logistical and production efficiencies of the oil sands recovery process and concurrently to expand capacity to increase production to approximately 4,000 barrels per day. In November 2017, PQECA formed a wholly owned subsidiary, Petrobloq, LLC, to design and develop a blockchain-powered supply chain management platform for the oil and gas industry. PQE also own a 25% interest in Recruiter.com, a recruitment venture that provides a website focused on careers in the oil and gas industry. PQE also owns the intellectual property rights to a patent-pending process (the "Extraction Technology") of extracting oil from oil sands utilizing a closed-loop solvent based extraction system, as more completely described below.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

3) Business Activity

Oil Sands Mining

The Company, acting primarily through its U.S. subsidiaries, is engaged in the business of mining, producing and processing oil sands containing bitumen and heavy oil into marketable crude oils and hydrocarbon products. To date, the Company's oil sands mining operations have been conducted on a mineral lease held by TMC Capital, a subsidiary of the Company, covering lands located in or near Asphalt Ridge, Utah (referred to herein as the "TMC Mineral Lease"), where sandstones impregnated with bitumen and heavy oil are mined or produced from structures and formations located at or near the surface. Once mined and extracted from surface or near-surface areas, the oil-bearing deposits are treated and processed at a processing facility that is both owned and operated by the Company and utilizes the Company's proprietary extraction technology (the "Extraction Technology").

Oil Sands Extraction & Processing Facility

In June 2011, the Company commenced the development of an oil sands extraction facility on state lands located near Maeser, Utah for the purpose of testing and evaluating the Extraction Technology. The facility was initially designed as a pilot plant, having a rated processing capacity of 250 barrels/day. By January 2014, the pilot plant was fully permitted and construction was completed by October 2014. The initial operations conducted at the pilot plant involved the testing of the Extraction Technology at full capacity and demonstrated its technical feasibility in extracting raw bitumen and heavy oil from solid and semi-sold oil sands formations and structures. During 2015, the pilot plant produced 10,000 barrels of oil from oil sands mined in the Asphalt Ridge area, including oil sands deposits mined and extracted from the TMC Mineral Lease. Most of the extracted oil was sold to an oil and gas distributor for resale to its refinery customers. The initial pilot plant constructed and operated by the Company had flexible capabilities, having the ability to produce both high quality heavy crude oil as well as lighter oil depending on the requirements of pipelines, distributors and/or refinery customers.

During 2015, when world crude oil prices fell dramatically, the Company determined that the transportation costs of hauling the ore from the mining site at the TMC Mineral Lease to its processing facility near Maeser, Utah was having a detrimental effect on the economics of the extraction operation and in 2016 temporarily suspended operations. In 2017, the plant was disassembled and moved from its location near Maeser, Utah to an area near its primary mine site within the TMC Mineral Lease. As part of the reassembly of the plant, the Company also initiated an expansion project where, through design changes and the acquisition and installation of additional equipment, the plant's processing capacity was increased from 250 barrels/day to 1,000 barrels/day. The new processing plant at Asphalt Ridge restarted operations and the production of heavy crude oil from oil deposits mined and extracted from the TMC Mineral Lease during the end of May 2018; however, the production of heavy crude oil at full capacity from the new processing facility is not anticipated until the last quarter of the 2019 fiscal year. Management's current estimate of the total costs of the new processing facility, including the expansion of production capacity (but excluding capitalized borrowing and lease maintenance costs) is in the range of US $24-27 million. The recent expansion of capacity at the new processing facility represents the initial phase of a larger project where the Company plans, through additional expansions or newly constructed facilities during the next three years, to increase its overall oil sands processing capacity in the Asphalt Ridge area to at least 4,000 barrels/day.

The Company expects to market finished crude oil produced at its processing facility directly to a refinery at a price representing a discount to the West Texas Intermediate Crude (WTI) benchmark price. The purchaser will take delivery of finished crude oil at or near the plant and transport it to a refinery in Nevada. The specifications of the crude oil produced at the plant are effectively tailored to meet customer (pipeline or refinery) specifications.

Mining operations, including the initial development of the mine located within the TMC Mineral Lease and the removal of the overburden soil layer covering the oil sands deposits are currently being conducted in preparation for the start-up of the new processing facility.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

The Company's proprietary extraction technology - consisting primarily of a process designed to extract oil from oil sands utilizing a closed-loop solvent based extraction system - is protected by both U.S. and foreign patents that are held by the Company and is more fully described below.

Mineral Leases & Resources

Through its acquisition of TMC on June 1, 2015, the Company indirectly acquired certain mineral rights under a Mining and Mineral Lease Agreement, dated as of July 1, 2013, between Asphalt Ridge, Inc., as lessor, and TMC, as lessee, covering lands consisting of approximately 1,229.82 acres near Temple Mountain area in Asphalt Ridge, Utah (the "TMC Mineral Lease"). More recently, the Company acquired mineral rights under two mineral leases entitled "Utah State Mineral Lease for Bituminous-Asphaltic Sands", each dated and made effective on June 1, 2018, entered into between the State of Utah's School and Institutional Trust Land Administration ("SITLA"), as lessor, and POSR, as lessee, covering lands in Asphalt Ridge that largely adjoin the lands held under the TMC Mineral Lease (collectively, the "SITLA Mineral Leases"). In addition to the acquisition of these recent mineral lease acquisitions, the Company recently closed the acquisition of a 50% interest in operating rights and interests related to oil sands under U.S. Federal oil and gas leases encompassing approximately 8,480 gross acres (4,240 net acres, less royalty) in the State of Utah. At this time, the Company (through its subsidiaries) holds mineral leases encompassing a total of 2,541.76 acres in the Asphalt Ridge areas, consisting of 1229.82 acres currently held under the TMC Mineral Lease, and an additional 833.03 acres and 478.91 acres, respectively, held under the SITLA Mineral Leases and operating interests and rights over a further net 4,240 acres.

The following table sets forth the gross and net developed and undeveloped acreage held under the TMC Mineral Lease.

|

TMC Mineral Lease Developed/Undeveloped Acreage (Gross/Net) |

|

|

Total Acreage |

|

|

Gross Acres (Working Interests & Royalty) |

1229.82 acres |

|

Net Acres (100% Working Interests, less Royalty) |

1111.76 acres |

|

Developed Acreage |

|

|

TME AR Mine #1/Permit Boundaries |

|

|

Gross Acres (Working Interests & Royalty) |

174.00 acres |

|

Net Acres (100% Working Interests, less Royalty) |

157.30 acres |

|

Undeveloped Acreage |

|

|

Acreage Outside TME AR Mine #1/Permit Boundaries |

|

|

Gross Acres (Working Interests & Royalty) |

1055.82 acres |

|

Net Acres (100% Working Interests, less Royalty) |

954.46 acres |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

The following table sets forth the total gross and total net undeveloped acreage of the SITLA Leases.

|

SITLA Leases |

|

|

Developed/Undeveloped Acreage (Gross/Net) |

|

|

SITLA Mineral Lease #53806 |

|

|

Total Gross Acres (Working Interests & Royalty) |

833.03 acres |

|

Total Net Acres (100% Working Interests) |

766.39 acres1 |

|

|

|

|

SITLA Mineral Lease #53807 |

|

|

Total Gross Acres (Working Interests & Royalty) |

478.91 acres |

|

Total Net Acres (100% of Working Interests) |

440.60 acres1 |

|

|

|

|

U.S. Federal Oil and Gas leases |

|

|

Total Gross Acres (Working interest and Royalty) |

8,480 Acres |

|

Total Net Acres (50% of working interest & Royalty) |

4,240 Acres |

|

|

|

|

All Acreage is Currently Undeveloped |

|

The TMC Mineral Lease

Under the TMC Mineral Lease, TMC has the exclusive right to explore for, mine and produce oil and other minerals associated with oil sands, subject to certain depth limits. The TMC Mineral Lease was amended on October 1, 2015 and further amended on March 1, 2016, on February 21, 2018, and most recently on November 21, 2018. The primary term of the TMC Mineral Lease, as amended, commenced July 1, 2013 and continues for six years, plus an extension period (as defined in the lease) of up to one additional year.

During the primary term, if TMC fails to satisfy the requirements of "continuous operations", the TMC Mineral Lease will terminate unless the parties agree in writing to continue the Lease. If TMC, at the end of the primary term, has satisfied the requirements of continuous operations, the TMC Mineral Lease will continue in effect beyond the primary term as long as TMC continues to comply with any applicable requirements of continuous operations. Under the lease, the term "continuous operations" consists of the following two requirements:

(a) Processing Capacity. TMC must construct or operate one or more facilities (or any expansion to an existing facility) having the capacity to produce an average daily quantity ("ADQ") of oil other hydrocarbon products from oil sands mined or extracted from the lease that, in the aggregate, will achieve (or exceed) the following:

By 07-01-2019, at 80% of an ADQ of 1,000 barrels/day;

By 07-01-2020, at 80% of an ADQ of 2,000 barrels/day; and

By 07-01-2021 (and for the remaining term of the Lease), at 80% of an ADQ of 3,000 barrels/day.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

(b) Minimum Operations. From and after July 1, 2019, TMC must achieve oil sands processing operations that equal (or exceed) the applicable ADQ requirements specified above either (i) during at least 180 days in each lease year, or (ii) during at least 600 days in any three consecutive lease years.

The TMC Mineral Lease is subject to termination under the circumstances described below:

| (i) | Termination will be automatic if there is a lack of a written financial commitment to fund PQE's proposed second 1,000 barrel per day processing facility or expansion of its current facility to an additional 1,000 barrels per day prior to March 1, 2019 or a lack of a written financial commitment to fund a proposed third 1,000 barrels per day processing facility or expansion of its current facility to an additional 1,000 barrels per day prior to March 1, 2020. | |

| (ii) | Cessation of operations or inadequate production due to increased operating costs or decreased marketability and production is not restored to 80% of capacity within three months of any such cessation will cause a termination. | |

| (iii) | Cessation of operations for longer than 180 days during any lease year or 600 days in any three consecutive years will cause a termination. | |

| (iv) | A failure of the Company's proposed three 1,000 barrels per day plants to produce a minimum of 80% of their rated capacity for at least 180 calendar days during the lease year commencing July 1, 2020 plus any extension periods will cause a termination. | |

| (v) | The Company may surrender the lease with 30 days written notice. | |

| (vi) | In the event of a breach of the material terms of the lease, the lessor will inform the lessee in writing and the Company will have 30 days to cure financial breaches and 150 days to cure any other non-monetary breach. |

(c) Advance Minimum Royalty. The Company is required to make certain advance royalty payments to the lessor under the TMC Mineral Lease. Future advance royalties required are (i) from July 1, 2018 to June 30, 2020, minimum payments of $100,000 per quarter, (ii) from July 1, 2020, minimum payments of $150,000 per quarter. Minimum payments commencing on July 1, 2020 will be adjusted for CPI inflation.

(d) Production Royalty. Production royalties payable under the TMC Mineral Lease, as amended are eight percent (8%) of the gross sales revenue, subject to certain adjustments up until June 30, 2020. After that date, royalties will be calculated on a sliding scale based on crude oil prices ranging from 8% to 16% of gross sales revenues, subject to certain adjustments. The TMC Mineral Lease is also subject to a 1.6% overriding royalty interest granted to the holder of a prior mineral lease in lands covered by the TMC Mineral Lease.

(e) Minimum Annual Expenditures. Minimum expenditures that must be made by TMC under the TMC Mineral Lease are $2 million per year commencing July 1, 2020 if a minimum daily production of 3,000 barrels/day during a 180-day period each year is not achieved.

(f) Permits. Full mining permits have been granted to the Company from the State of Utah Division of Oil, Gas, and Mining for the mining and development of this resource. Mining operations, including the initial development of an open pit at the property and removal of the overburden soil layer has already been performed. In addition to the mining permits, all environmental, construction, utility and other local permits necessary for the construction of the plant and the processing of the oil sands have been granted to the Company.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

The SITLA Mineral Leases

The SITLA Mineral Leases have a primary term of ten (10) years, and will continue in effect thereafter for as long as (a) bituminous sands are produced in paying quantities, or (b) the Company is otherwise engaged in diligent operations, exploration or development activity and certain other conditions are satisfied. Generally, the SITLA Mineral Leases will not continue in effect after the 20th anniversary of their effective dates except by production of leased substances in paying quantities. An annual minimum royalty of $10 an acre must be paid during the first ten years of the SITLA Leases; from and after the 11th year of the leases, the annual minimum royalty may be adjusted by the lessor based on certain "readjustment" provisions in the SITLA Mineral Leases. Annual minimum royalty paid in any lease year may be credited against production royalties accruing in the same year.

The SITLA Mineral Leases provide that the Company must pay (i) an annual rent equal to the greater of $1 an acre or a fixed sum of $500 (without regard to acreage), and (ii) a production royalty of 8% of the market price received by it for products produced from the leases at the point of first sale, less reasonable actual costs of transportation to the point of first sale (with the royalty rate subject to increase on or after the 10th anniversary of the lease, subject to a 12.5% cap during the term thereof, and a proviso that production royalties under the leases shall never be less than $3.00/bbl during the term of the leases). As the sole lessee under the SITLA Mineral Leases, the Company owns 100% of the working interests under the leases, subject to payment of annual rentals, advance annual minimum royalty, and production royalties.

U.S. Federal Oil & Gas Leases

The U.S. Federal Oil & Gas Leases are for an indefinite period of time. The lease attracts an overriding royalty of a gross 12.5% of which our 50% share is 6.25%. The Company owns a 50% share of the operating rights and interest in the U.S. Federal Oil & Gas Lease.

Technology Development

The Company continues to develop its operations by processing purchased native oil sands ore, as well as native oil sands ore produced through the mining operations of its subsidiary (TMC) on a lease in Asphalt Ridge, Utah, using its a patented closed loop, continuous flow, anticipated scalable and environmentally safe Extraction Technology. The process allows the extraction of hydrocarbons from a wide range of both "water- wet" and/or "oil-wet" oil sands deposits and other hydrocarbon sediment types. The Company's oil extraction process takes place in a completely closed loop system that continuously re-circulates and recycles the solvent after it has completely separated the asphaltene and heavy oils from the oil sands. The closed loop system is capable of recovering over 99% of the all hydrocarbons from the oil sands, making this technology very environmentally friendly. The only two end products of the process are high quality heavy oil and clean sands.

The Extraction Technology utilizes no water in the process, is anticipated to produce no greenhouse gases, requires no high temperature and/or pressure for the extraction process, and expects to extract up to 99% of all hydrocarbon content and recycle up to 99% of the solvents. The proprietary solvent composition consist s of hydrophobic, hydrophilic and polycyclic hydrocarbons. It is expected to dissolve up to 99% of heavy bitumen/asphalt and other lighter hydrocarbons from the oil sands, and prevent their precipitation during the extraction process. Solvents used in this composition form an azeotropic mixture which has a low boiling point of 70 - 75 C degrees and it is expected to allow recycling up to 99% of the solvent. These features, in the event they produce as anticipated by the Company, make it possible to perform hydrocarbon extraction from oil sands at mild temperatures of 50 - 60 degrees C, with no vacuum or/and pressure applied that would lead to high energy and economic efficiency of the extraction of oil from the overall oil sands extraction process.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

Another key element of the Company's extraction process is applying its own proprietary separation/extraction process, based on a proprietary/patent - pending "liquid fluidized bed" solvent extraction system for bitumen/oil from oil sands extraction. A "liquid fluidized bed" style reactor is anticipated to provide continuous mixing of the (liquid) solvent and the solid ore particles. It is intended to allow a continuous flow process with optimal material/mass/energy balances. PQE's solvent based technology uses only a fraction of the energy needed to produce a barrel of oil compared to the water based technologies used in Canada. The Company's process also employs multiple energy saving technology processes to reduce energy consumption even further. This has resulted in a high level of energy efficiency during the oil extract ion process. The Company's patented design also includes exceptionally efficient heat exchange and distillation/rectification systems. This energy efficiency makes heavy oil sands extraction facilities economical to operate.

The Company has been granted patents for elements of the Extraction Technology with both the USPTO in the United States and CIPO in Canada, as well as China and Russia, and intends to file patent applications worldwide with respect to the same elements in the future. The Company has been granted technology patents in the United States, Canada, and Russia.

On March 27, 2013, the Company entered into an intellectual property license agreement with a private arm's length Canadian company, TS Energy Ltd., which has agreed to act as the sole and exclusive licensee of the Extraction Technology within Canada and the Republic of Trinidad and Tobago.

4) Outlook

Oil Sands

The Company's technology had been tested at full capacity as of August 31, 2015 and an independent production evaluation was completed shortly thereafter. PQE initially hired and trained its own personnel to operate the plant but since laid off all employees due to the price volatility in the international markets reducing viable production at limited volumes in 2015. At that time, the Company was able to produce oil/hydrocarbon products which could be sold locally in Asphalt Ridge to the oil and gas distributors or refineries.

The Company had also obtained the last full production permit (Ground Water Permit) in order to commence continuous plant operations.

The plant has subsequently been relocated to the TMC mining site to improve logistical and production efficiencies of the Oil Sands recovery process. The Company has substantially completed its expansion project to increase the production capacity to at least 1,000 barrels per day. The Company has conducted numerous production runs and has commenced a commercial level extraction process at this time with registered sales of heavy oil product. The Company is currently doing its first maintenance turnaround to prepare for 2019 operations and is addressing minor issues that were encountered during fourth quarter 2018 production operations.

In order to fund the relocation of the plant and the expansion of the production capacity, the Company entered into a memorandum of understanding (the "Memorandum") with Deloro Energy, LLC ("Deloro") on September 11, 2017. Under the Memorandum, Deloro was to provide financing of $10,000,000 to the Company in three separate tranches. On the completion of the $10,000,000 advance, the loan would have been automatically converted to a 49% equity interest in each of POSR and TMC.

Deloro failed to make advances as per the agreed upon schedule and on May 2, 2018, PQECA and Deloro agreed to terminate the Memorandum and apply the proceeds received from Deloro, being $3,600,000 to date, towards a subscription for 6,000,000 units of the Company at $0.60 per unit. Each unit consists of one common share and one common share purchase warrant. The common share purchase warrant entitles the holder to purchase one additional common share of the Company at a price of $0.91 per share and expires on May 22, 2021.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

Accord Acquisition

The Company acquired a 57.3% interest in Accord on July 4, 2016, which has subsequently been diluted to a 44.7% interest by other third party equity investments made in Accord. Accord is engaged in the recovery of heavy oil, utilizing two technologies licensed to it from certain of its affiliated entities. The licenses allow Accord to utilize the technologies on any oil field it acquires. The first technology, known as SWEPT, is designed to recover hydrocarbons from wells and structures with low pressure or no energy drive mechanism, from residual or partially depleted properties in mature fields, and from structures having complex geophysical matrices or that contain tight oil, in each case by improving rock and fluid properties through the introduction of directed energy waves. The second technology, known as S-BRPT, is designed to recover solid and liquid hydrocarbons through conversion to gaseous forms followed by well-based recovery at greater depths, combining both specially designed on-site well production and recovery methodologies. Accord is currently utilizing these licensed technologies on parts of the 7,000 acres under mineral leases located in southwest Texas that it acquired in 2016, which include 81 shallow oil wells that historically had limited production. To date, Accord has drilled three new wells on these properties and the fields treated with the technology licensed to Accord are expected to increase oil production. Commercial levels of production have not yet been achieved.

Petrobloq, LLC

In November 2017 PQE CA formed a subsidiary company, Petrobloq LLC. Petrobloq has entered into an agreement with First Bitcoin Capital Corp. ("FBCC"), a global developer of blockchain-based applications, to design and develop a blockchain-powered supply chain management platform for the oil and gas industry. The platform is being designed to be a "one-stop shop" that will provide both small and large oil and gas producers and operators with the ability to customize their own distributed ledger modules that will permit each company, in a secure "closed" environment, to document, track, and account for the supply of equipment, materials and services in project, field, and lease development. The agreement with FBCC requires that PQE pay FBCC $500,000 for the services to be provided. An initial $100,000 was paid to FBCC during fiscal 2018 and a further $152,500 has been paid to FBCC to continue its research and development activities.

On August 17, 2018, the Company entered into a development agreement with MetzOhanian, a software engineering firm based in Austin, Texas, to develop blockchain applications for PetroBloq. MetzOhanian specializes in blockchain engineering, supply chain management software development, and digital security consulting. MetzOhanian will be working with Petrobloq to develop blockchain applications aimed at increasing supply chain transparency and efficiency in the oil and gas sector.

The supply chain management platform is currently in the v1 Beta early stage of development and research and development activities are continuing. The current development plans are that the platform will be blockchain agnostic and able to run on any blockchain that is commercially available. The Company's business does not entail, and it is not anticipated that it will entail, the creation, issuance, or use of any digital assets.

In February 2018, Petrobloq leased a 1,800 square foot office in Calabasas, California to serve as its headquarters. The office is staffed with four contract employees serving as Project Manager; Director of Operations, Solutions Architect and Senior Database Developer, respectively.

Recruiter.com

In November 2016, the Company entered into a joint venture with Recruiter.com, Inc. and OilPrice.com and jointly formed a Delaware limited liability company, Recruiter.com Oil and Gas Group LLC ("Recruiter. OGG"), which is owned 25% by us, 25% by Recruiter.com, Inc., 45% by OilPrice.com and 5% by two individuals. Net profits will be split in accordance with ownership interests. In consideration for the 25% equity interest, the Company issued 83,333 shares to Recruiter.com, Inc. Recruiter. OGG is a recruitment venture providing a website based for careers in the oil and gas industry.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

5) Summary of Quarterly Result

The following selected financial information for the previous eight quarters, as shown in the following table, was prepared in accordance with IFRS.

3 months ended |

February 28, 2019 ($) |

November 30, 2018 ($) |

August 31, 2018 ($) |

May 31, 2018 ($) |

| Total revenues | 21,248 | - | - | - |

| Net loss | 2,682,250 | 6,272,456 | 6,555,072 | 3,178,839 |

| Basic and diluted net loss per share* | 0.03 | 0.07 | 0.09 | 0.05 |

3 months ended |

February 28, 2018 ($) |

November 30, 2017 ($) |

August 31, 2017 ($) |

May 31, 2017 ($) |

| Total revenues | - | - | - | - |

| Net loss | 1,732,532 | 3,645,712 | 3,101,430 | 3,581,788 |

| Basic and diluted net loss per share* | 0.03 | 0.07 | 0.12 | 0.46 |

* Adjusted for 30 for 1 share consolidation on May 5, 2017.

The net loss for the three months ended February 289, 2019 includes:

(i) $72,764 of royalty expense, included in cost of sales due to the expiry of advanced royalties paid to the TMC mineral lease lessor;

(ii) Certain production related expenses related to the oil extraction facility of $65,231, primarily labor and maintenance related expenditure, all other costs are being capitalized until such time as the production plant has entered its production stage and is no longer in test phase;

(iii) The capital raising fee raised in the previous quarter, related to a letter of credit obtained from a financial institution was reclassified as a prepaid expense during the current quarter and is being amortized over the letter of credit term of one year. The amortization of this expense is included in interest expense;

(iv) Interest expense of $1,325,970 includes the amortization of the commitment fee mentioned in (iii) above of $571,835, the amortization of debt discount related to convertible notes of $666,076 and interest expense of $88,059, primarily on convertible notes advanced to the Company during the current year;

(v) Professional fees of 832,119 related to the expansion of the plant and advisory fees;

(vi) Share based compensation of $554,325 related to options issued to our directors in June 2018; and

(vii) Travel and promotional expenses of $473,953 primarily related to travel costs and marketing expenditure.

The net loss for the three months ended November 30, 2018 includes:

(i) $33,750 of cost of sales due to the expiration of advanced royalty payments paid to the mineral lease lessor;

(ii) capital raising fees of $1,276,980 related to the letter of credit facility provided to the Company by Bay Capital Privat Equity;

(iii) legal fees of $681,365 related to the expansion of the plant and the various fund raising initiatives undertaken during the current fiscal period;

(iv) professional fees of $1,509,153 related to the expansion of the plant;

(v) Share based compensation of $554,325 related to options issued to directors and officers in June 2018; and

(vi) Travel and promotional expenses of $1,228,464, primarily related to marketing, public relations and travel costs.

The net loss for the three months ended August 31, 2018, includes:

(i) $38,213 of cost of sales, due to the expiration of advanced royalty payments paid to the lessor;

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

(ii) $527,872 of travel and promotional, and investor relation expenses due to advisory board fees and marketing activities undertaken to market the company and its production processes and technology;

(iii) $1,867,229 of professional fees predominantly composed of advisory board fees and fees paid to management and financial consultants; and

(iv) $2,832,523 of share based compensation due to the issue of 8,350,000 options to directors, officers and consultants during the quarter.

The net loss for the three months ended May 31, 2018, includes;

(i) marketing and public relations activity of approximately $1,560,000;

(ii) professional fees of $890,000, being primarily composed of advisory fees on developing the business strategy; and

(iii) Salaries and wages also increased significantly to $252,000 as the Company completed its expansion project and employed skilled people to assist with the project.

The net loss for the three months ended February 28, 2018, has no significant and abnormal expenditures. General and administrative expenses have increased as the Company prepares for the completion of the expansion project, in addition marketing expenditure has increased as the Company undertakes to increase awareness of the impending completion of the expansion project.

The net loss for the three months ended November 30, 2017 includes:

(i) stock based compensation of $2,505,647 related to the grant of 1,425,000 stock options to certain directors of the Company; and

(ii) the Company incurred an increase in public relations expenditure of $202,844 to renew interest in its oil sands recovery business.

The net loss for the three months ended August 31, 2017 includes:

(i) a loss on conversion of equity of $1,459,172 related primarily to an agreement entered into whereby debt due to the Chair of the Board totaling $3,000,000, including interest thereon was converted to equity at a loss of $1,545,821.

The net loss for the three months ended May 31, 2017 includes:

(i) a loss on conversion of equity of $2,253,385 related primarily to agreements entered into whereby debt totaling $12,189,956 was converted into 31,083,281 common shares on May 19, 2017, these shares were issued subsequent to the quarter end.

6) Comparison of results of operations for the three months ended February 28, 2019 and 2018

Net Revenue, Cost of Sales and Gross Loss

The Company continues to run test production on its 1,000 barrel per day plant and continuing with its expansion project to increase production capacity by an additional 3,000 barrels per day. Revenue generation during the quarter of $21,248 represents the sale of hydrocarbon products to refineries to determine the commercial quality of our hydrocarbon products. We expect to sell further test product during the third quarter of fiscal 2019 and commence commercial production in the fourth quarter. Prior to August 31, 2018, due to the volatility in oil markets and the limited production capacity at the plant, no production took place during the year ended August 31, 2018, resulting in no revenue generation. During the year ended August 31, 2018, the Company relocated its production plant to the Asphalt Ridge mineral site and has expanded production capacity to approximately 1,000 barrels per day with a further expansion to 3,000 barrels per day underway. Management expects to generate revenue from the plant in fiscal 2019.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

The cost of sales during the three months ended February 28, 2019 and 2018 consists of; i) advance royalty payments which expire at the end of the calendar year two years after the payment has been made; and ii) certain production related expenses consisting of labor and maintenance expenditure.

Operating Expenses

Operating expenses of $2,586,602 and $1,656,374 for the three months ended February 28, 2019 and 2018, respectively, an increase of $930,228 or 56.2%. The increase in operating expenses is primarily due to:

a. Depletion, depreciation and amortization of $16,343 and $295,758 for the three months ended February 28, 2019 and 2018, respectively, a decrease of $279,415 or 94.5%. The Company has ceased depletion, depreciation and amortization on production related assets and reserves until such time as the plant recommences operations, which is expected to occur during the fourth quarter of 2019.

b. Capital raising fee of $1,276,980 and $0 for the three months ended February 28, 2019 and 2018, respectively, a decrease of $1,276,980 or 100%. The capital raising fee related to commitment fees paid to secure a letter of credit and funding arrangement with a financial institution which was expensed in the previous quarter. The amount was reclassified in the current quarter as a prepaid expense and is being amortized over the term of the funding arrangement. The amortization expense of $571,835 is included under interest expense;

c. Interest expense of $1,325,970 and $120,114 for the three months ended February 28, 2019 and 2018, respectively, an increase of $1,205,856. The increase is primarily due to the amortization of the commitment fee mentioned in a) above of $571,835, the amortization of debt discount related to convertible notes of $666,076 and a decrease in interest expense of $32,055 during the current fiscal period;

d. Legal fees of $222,969 and $6,914 for the three months ended February 28, 2019 and 2018, respectively, an increase of $216,055. The increase is primarily related to the expansion of the plant and the various fund raising initiatives undertaken by the Company during the current fiscal period;

e. Professional fees of $832,119 and $544,695 for the three months ended February 28, 2019 and 2018, respectively, an increase of $287,424 or 52.8%. The increase in professional fees is primarily due to professional fees paid to various vendors related to the expansion of the plant and management advisory board services;

f. Salaries and wages of $293,091 and $204,090 for the three months ended February 28, 2019 and 2018, respectively, an increase of $89,001 or 43.6%. The increase in salaries and wages expense is primarily due to the increase in headcount as the Company plans for commercial production of hydrocarbon products and increased headcount on administrative functions.

g. Stock based compensation of $554,325 and $0 for the three months ended February 28, 2019 and 2018, respectively, an increase of $554,325. The increase relates to stock options issued to certain members of management and directors during the prior year, which vest over a four year period.

h. Travel and promotion of $473,953 and $263,655 for the three months ended February 28, 2019 and 2018, respectively, an increase of $210,298 or 79.8%. The increase is primarily related to an increase in business activity resulting in increased airfare and hotel costs incurred on site visits and on investor relations activities. In addition there has been an increase in marketing activity related to our unique technology.

Profit on settlement of liabilities

Profit on settlement of liabilities of $90,836 and $0 for the three months ended February 28, 2019 and 2018, respectively, an increase of $90,836. The Company settled liabilities to certain vendors and certain directors fees outstanding by issuing shares of common stock at a slight premium to traded prices on the various settlement dates.

Loss on settlement of convertible debt

Loss on settlement of convertible debt of $20,137 and $0 for the three months ended February 28, 2019 and 2018, an increase of $20,137. The current period loss was realized on the conversion of $56,500 of convertible debt including interest thereon of $13,479 by the issue of 145,788 common shares at a discount to market prices.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

Equity loss from investment in Accord GR Energy

Equity loss from investment in Accord Energy GR was $50,000 and $0 for the three months ended February 28, 2019 and 2018, respectively, an increase of $50,000.

7) Comparison of results of operations for the six months ended February 28, 2019 and 2018

Net Revenue, Cost of Sales and Gross Loss

The Company continues to run test production on its 1,000 barrel per day plant and continuing with its expansion project to increase production capacity by an additional 3,000 barrels per day. Revenue generation during the quarter of $21,248 represents the sale of hydrocarbon products to refineries to determine the commercial quality of our hydrocarbon products. We expect to sell further test product during the third quarter of fiscal 2019 and commence commercial production in the fourth quarter. Prior to August 31, 2018, due to the volatility in oil markets and the limited production capacity at the plant, no production took place during the year ended August 31, 2018, resulting in no revenue generation. During the year ended August 31, 2018, the Company relocated its production plant to the Asphalt Ridge mineral site and has expanded production capacity to approximately 1,000 barrels per day with a further expansion to 3,000 barrels per day underway. Management expects to generate revenue from the plant in fiscal 2019.

The cost of sales during the six months ended February 28, 2019 and 2018 consists of; i) advance royalty payments which expire at the end of the calendar year two years after the payment has been made; and ii) certain production related expenses consisting of labor and maintenance expenditure.

Operating Expenses

Operating expenses of $8,586,925 and $5,190,835 for the six months ended February 28, 2019 and 2018, respectively, an increase of $3,396,090 or 65.4%. The increase in operating expenses is primarily due to:

a. Depletion, depreciation and amortization of $32,516 and $593,516 for the six months ended February 28, 2019 and 2018, respectively, a decrease of $561,000 or 94.5%. The Company has ceased depletion, depreciation and amortization on production related assets and reserves until such time as the plant recommences operations, which is expected to occur during the fourth quarter of 2019.

b. Interest expense of $1,544,649 and $241,598 for the six months ended February 28, 2019 and 2018, respectively, an increase of $1,303,051. The increase is primarily due to the amortization of the commitment fee mentioned in a) above of $571,835, the amortization of debt discount related to convertible notes of $802,878 and a decrease in interest expense of $71,662 during the current fiscal period, primarily due to the conversion to capital of several interest bearing debt securities in the prior year;

c. Legal fees of $904,334 and $39,539 for the six months ended February 28, 2019 and 2018, respectively, an increase of $864,795. The increase is primarily related to the expansion of the plant and the various fund raising initiatives undertaken by the Company during the current fiscal period;

d. Professional fees of $2,341,272 and $786,356 for the six months ended February 28, 2019 and 2018, respectively, an increase of $1,554,916 or 197.7%. The increase in professional fees is primarily due to professional fees paid to various vendors related to the expansion of the plant and management advisory board services;

e. Salaries and wages of $529,703 and $386,090 for the six months ended February 28, 2019 and 2018, respectively, an increase of $143,613 or 37.2%. The increase in salaries and wages expense is primarily due to the increase in headcount as the Company plans for commercial production of hydrocarbon products and increased headcount on administrative functions.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

f. Stock based compensation of $1,108,650 and $2,505,647 the six months ended February 28, 2019 and 2018, respectively, a decrease of $1,396,997. The decrease related to stock options with immediate vesting issued to certain directors in the prior period. The current period charge represents the charge for stock options with a four year vesting period.

g. Travel and promotion of $1,702,417 and $343,469 for the six months ended February 28, 2019 and 2018, respectively, an increase of $1,355,948 or 395.7%. The increase is primarily related to an increase in business activity resulting in increased airfare and hotel costs incurred on site visits and on investor relations activities. In addition there has been an increase in marketing activity related to our unique technology.

Loss on settlement of liabilities

Loss on settlement of liabilities of $18,137 and $0 for the six months ended February 28, 2019 and 2018, respectively, an increase of $18,137. The loss realized in the first quarter upon the settlement of $545,194 of debt by the issue of 681,151 common shares at a discount to market prices was offset by the Company settling liabilities to certain vendors and certain directors fees outstanding by issuing shares of common stock at a slight premium to traded prices on the various settlement dates.

Loss on settlement of convertible debt

Loss on settlement of convertible debt of $99,547 and $0 for the six months ended February 28, 2019 and 2018, an increase of $20,137. The current period loss was realized on the conversion of $311,578 of convertible debt including interest thereon of $13,479 by the issue of 462,011 common shares at a discount to market prices.

Equity loss from investment in Accord GR Energy

Equity loss from investment in Accord Energy GR was estimated at $100,000 and $0 for the six months ended February 28, 2019 and 2018, respectively, an increase of $100,000.

8) Liquidity and Capital Resources

As at February 28, 2019, the Company had liquidity of approximately $716,451, which is composed entirely of cash. The Company also had a working capital deficiency of approximately $6,002,792, due primarily to accounts payable, short term loans and convertible loans and accrued interest thereon which remains outstanding as of February 282019. The Company raised $8,091,453 in private placements, a further net proceeds of $517,000 from debt and $5,618,750 from convertible debt. These funds were primarily used on the expansion of the oil facility, expenditures related thereto such as professional fees, marketing costs and notes receivable advanced to third parties.

Subsequent to February 28, 2019, in terms of various subscription agreements entered into with third parties, the Company raised an additional $1,482,000 in proceeds from private equity issues.

The Company continues to work on several other financing options to secure additional financing on reasonable terms. However, should the Company not be able to secure such funding its liquidity may not be sufficient to fund its operations, debt obligations and the capital needed to complete development of its Extraction Technology.

The Company has not paid any dividends on its common shares. The Company has no present intention of paying dividends on its common shares as it anticipates that all available funds will be reinvested to finance the growth of its business.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

In addition to commitments otherwise reported in this MD&A, the Company's contractual obligations as at February 28, 2019, include:

|

Contractual Obligations |

Total ($ millions) |

Up to 1 Year ($ millions) |

2 - 5 Years ($ millions) |

After 5 Years ($ millions) |

|

Convertible Debt[1] |

6.52 |

6,52 |

- |

- |

|

Debt[2] |

1.76 |

1.32 |

0.44 |

- |

|

Total Contractual Obligations |

8.28 |

7.84 |

0.44 |

- |

[1] Amount includes estimated interest payments. The recorded amount as at November 30, 2018 was approximately $3.45 million.

[2] Amount includes estimated interest payments. The recorded amount as at November 30, 2018 was approximately $1.64 million.

9) Off-Balance Sheet Arrangements

To the best of management's knowledge, there are no off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on the results of operations or financial condition of the Company.

10) Related Party Transactions

During the six months ended February 28, 2019, the Company had the following related party transactions not otherwise disclosed in this MD&A:

Transactions with executive officers and directors

During the six months ended February 28, 2019 and 2018, the Company received additional advances of $67,000 and $nil from the Chair of the Board of Directors and various private companies controlled by him.

On May 18, 2017, the Company entered into a Securities Purchase Agreements whereby it agreed to convert an aggregate principal debt of $115,000, including interest thereon, owing to the Chair of the Board or companies controlled by him into 325,779 common shares at a conversion price of $0.353 per share.

On September 4, 2018, the Company entered into a Debt Settlement Agreement whereby it agreed to convert $249,285 of advances made to the Company by the Chair of the Board into 336,871 common shares at a conversion price of $0.74 per share.

Key management personnel and director compensation

The remuneration of the Company's directors and other members of key management, who have the authority and responsibility for planning, directing, and controlling the activities of the Company, consist of the following amounts:

| Six months ended | ||||||

| February 28, 2019 |

February 28, 2018 |

|||||

| Salaries, fees and other benefits | $ | 361,506 | $ | 289,500 | ||

| Share based compensation | 839,886 | 2,505,647 | ||||

| $ | 1,201,392 | $ | 2,795,147 | |||

At February 28, 2019, $175,457 is due to members of key management and directors for unpaid salaries, expenses and directors' fees (August 31, 2018 - $1,065,392).

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

Due to and from director

As of February 28, 2019 and August 31, 2018, the Company owed various private companies controlled by the Chair of the Board the aggregate sum of $67,000 and $nil, respectively.

As at February 28, 2019, the Chair of the Board of Directors owed the Company $424,179.

11) Outstanding Share Data

As at the date hereof, the Company had the following common shares, share purchase options, warrants and convertible securities outstanding:

| Total common shares outstanding | 126,487,334 | ||

| Total common share purchase options | 9,808,333 | ||

| Total common share purchase warrants and broker warrants | 22,478,389 | ||

| Total other securities reserved for issuance | 10,068,231 | ||

| Fully diluted shares outstanding | 168,842,287 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

Share Purchase Warrants

As at the date hereof, an aggregate of 20,714,715 share purchase warrants were outstanding, as follows:

|

Expiry Date |

Exercise Price |

Warrants Outstanding |

|

|

|

|

|

April 12, 2019 |

USD $4.95 |

16,667 |

|

April 19, 2019 |

USD $0.48 |

260,416 |

|

August 19, 2019 |

USD $7.50 |

66,665 |

|

September 4, 2019 |

USD $0.87 |

287,356 |

|

September 17, 2019 |

USD $1.10 |

750,000 |

|

October 12, 2019 |

USD $0.86 |

290,500 |

|

October 15, 2019 |

USD $ 0.86 |

290,500 |

|

November 5, 2019 |

CAD $28.35 |

25,327 |

|

January 25, 2020 |

USD $0.37 |

147,058 |

|

February 27, 2020 |

USD $0.37 |

135,135 |

|

March 9, 2020 |

USD $1.50 |

114,678 |

|

June 7, 2020 |

USD $0.525 |

1,190,476 |

|

June 14, 2020 |

USD $1.50 |

329,080 |

|

July 26, 2020 |

USD $1.50 |

1,637,160 |

|

August 28, 2020 |

USD $0.94 |

1,311,242 |

|

August 28, 2020 |

USD $1.00 |

246,913 |

|

August 28, 2020 |

USD $1.50 |

35,714 |

|

September 6, 2020 |

USD $1.01 |

925,925 |

|

October 11, 2020 |

USD $ 1.35 |

510,204 |

|

October 11, 2020 |

USD $1.50 |

10,204 |

|

November 7, 2020 |

USD $0.61 |

20,408 |

|

November 7, 2020 |

USD $0.66 |

300,000 |

|

November 8, 2020 |

USD $1.01 |

918,355 |

|

December 7, 2020 |

USD $0.67 |

185,185 |

|

December 7, 2020 |

USD $1.50 |

3,188,735 |

|

January 10, 2021 |

USD $1.50 |

1,437,557 |

|

January 11, 2021 |

USD $1.50 |

307,692 |

|

March 29, 2021 |

USD$ 0.465 |

1,481,481 |

|

April 8, 2021 |

CAD $4.73 |

57,756 |

|

May 22, 2021 |

USD $0.91 |

6,000,000 |

|

|

|

24,478,389 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

Share Purchase Options

The Company has a 20% fixed number share option plan, most recently approved by the shareholders on March 6, 2015. Pursuant to this plan, the Company may grant up to 25,297,467 share purchase options to directors, officers, employees, and consultants. Such options are non-transferable, will have a maximum term of ten years and terminate 12 months (or other such shorter time as determined by the directors) following cessation of the optionee's position with the Company, subject to the expiry date of such option. As at the date hereof, an aggregate of 9,808,333 share purchase options:

| Expiry Date | Exercise Price |

Options Outstanding |

Options Exercisable |

||||||

| February 1, 2026 | CAD$ | 5.85 | 33,333 | 33,333 | |||||

| November 30,2027 | CAD$ | 2.27 | 1,425,000 | 1,425,000 | |||||

| June 5, 2028 | CAD$ | 1.00 | 8,350,000 | 3,400,000 | |||||

| 9,808,333 | 4,858,333 |

Other Securities Reserved for Issuance

The Company has reserved 10,068,231 common shares for possible issuance in the event the convertible debentures issued between September 4, 2018 and January 29, 2019 are converted into shares of common stock at conversion prices ranging from $0.40 to $1.00 per share.

12) Financial Instruments and Risk Management

As at February 28, 2019, the Company's financial instruments are comprised of cash, trade and other receivables, accounts payable and accrued expenses, the fair values of which approximate their carrying values due to their short-term maturity, and convertible debentures and long-term debt, which are carried at amortized cost. The Company classifies its cash as fair value through profit or loss. The Company's financial instruments are exposed to a variety of related risks. The Company's risk exposures and the impact on the Company's financial instruments are described under "Risks and Uncertainties" below.

13) Management of Capital

The Company's objectives when managing capital are to safeguard the Company's ability to continue as a going concern and to maintain a flexible capital structure which optimizes the costs of capital at an acceptable level. The Company considers its capital for this purpose to be its shareholders' equity and long-term liabilities.

The Company manages its capital structure and makes adjustments to it in light of changes in economic conditions and the risk characteristics of the underlying assets. To maintain or adjust the capital structure, the Company may seek additional financing or dispose of assets.

In order to facilitate the management of its capital requirements, the Company monitors its cash flows and credit policies and prepares expenditure budgets that are updated as necessary depending on various factors, including successful capital deployment and general industry conditions. The budgets are approved by the Board of Directors. There are no external restrictions on the Company's capital.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

14) Significant Accounting Policies and Critical Accounting Estimates

The following is a summary of new standards, amendments and interpretations that are effective for annual periods beginning on or after January 1, 2017:

a) IAS 7, Statement of Cash Flows ("IAS 7") - amendments

The amendments to IAS 7 require additional disclosure of changes in liabilities arising from financing activities.

b) IAS 12, Income Taxes ("IAS 12") - amendments

The amendments to IAS 12 clarify the recognition of deferred tax assets for unrealized losses.

The application of the above amendments did not have any material impact on the consolidated financial statements presented.

The following is a summary of new standards, amendments and interpretations that have been issued but not yet adopted in these consolidated financial statements:

a) IFRS 9, Financial Instruments ("IFRS 9")

IFRS 9 uses a single approach to determine whether a financial asset is measured at amortized cost or fair value, replacing the multiple classification options in IAS 39. The approach in IFRS 9 is based on how an entity manages its financial impairment methods in IAS 39. IFRS 9 is effective for annual periods beginning on or after January 1, 2018, with earlier adoption permitted. The Company is currently evaluating the impact of the adoption of the amendments on its financial statements; however, the impact, if any, is not expected to be significant.

b) IFRS 15, Revenue from Contracts with Customers ("IFRS 15")

IFRS 15 establishes a comprehensive framework for determining whether, how much and when revenue is recognized. It replaces existing revenue recognition guidance, including IAS 18 Revenue, IAS 11 Construction Contracts and IFRIC 13 Customer Loyalty Programmes. IFRS 15 is effective for annual periods beginning on or after January 1, 2018, with early adoption permitted.

c) IFRS 16 Leases ("IFRS 16")

IFRS 16 provides a single lessee accounting model, requiring lessees to recognize assets and liabilities for all leases unless the lease term is 12 months or less or the underlying asset has a low value. Lessors continue to classify leases as operating or finance, with IFRS 16's approach to lessor accounting substantially unchanged from its predecessor IAS 17 Leases. IFRS 16 replaces IAS 17 Leases, IFRIC 4 Determining Whether an Arrangement Contains a Lease, SIC -15 Operating Leases - Incentives, and SIC - 27 Evaluating the Substance of Transactions Involving the Legal Form of a Lease. IFRS 16 is effective for annual periods beginning on or after January 1, 2019, with earlier adoption permitted if IFRS 15 Revenue from Contracts with Customers is also applied.

d) IFRS 2 Share-based Payment ("IFRS 2") - amendments

The amendments to IFRS 2 provide clarification and guidance on the treatment of vesting and non-vesting conditions related to cash-settled share-based payment transactions, on share-based payment transactions with a net settlement feature for withholding tax obligations, and on accounting for modification of a share-based payment transaction that changes its classification from cash-settled to equity-settled. The amendments to IFRS 2 are effective for annual periods beginning on or after January 1, 2018, with earlier application permitted.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

e) IFRIC 23 - Uncertainty Over Income Tax Treatments ("IFRIC 23")

IFRIC 23 clarifies application of the recognition and measurement requirements in IAS 12 when there is uncertainty over income tax treatments. It is effective for annual periods beginning on or after January 1, 2019 with early adoption permitted.

The Company is currently assessing the impact that these new and amended standards will have on the consolidated financial statements.

15) Litigation and Contingencies

Legal Matters

On December 27, 2018, the Company executed and delivered: (i) a Settlement Agreement (the "Settlement Agreement") with Redline Capital Management S.A. ("Redline") and Momentum Asset Partners II, LLC; (ii) a secured promissory note payable to Redline in the principal amount of $6,000,000 (the "Note") with a maturity date of 27 December 2020, bearing interest at 10% per annum; and (iii) a Security Agreement (together with the Settlement Agreement and the Note, the "Redline Agreements") among the Company, Redline, and TMC Capital, LLC ("TMC"), an indirect wholly-owned subsidiary of the Company.

After undertaking an in-depth analysis of the Redline Agreements in the context of the underlying transactions and events, special legal counsel to the Company has opined that the Redline Agreements are likely void and unenforceable.

The Company's special legal counsel regards the possibility of Redline's success in pursuing any claims against the Company or TMC under the Redline Agreements as less than reasonably possible and therefore no provision has been raised against these claims.

The Company is currently evaluating the options and remedies that are available to it to ensure that the Redline Agreements are declared as void or are rescinded and extinguished.

From time to time, the Company is the subject of litigation arising out of the Company's normal course of operations. While the Company assesses the merits of each lawsuit and defends itself accordingly, the Company may be required to incur significant expenses or devote significant resources to defend itself against such litigation. Accruals are made in instances where it is probable that liabilities may be incurred and where such liabilities can be reasonably estimated. Although it is possible that liabilities may be incurred in instances for which no accruals have been made, management has no reason to believe that the ultimate outcome of these matters would have a significant impact on the Company's consolidated financial position.